This blog is part of the Collaborative Working Champions series of ten blogs on Modern Collaborative Working

In our last blog (#3) we looked mostly at project procurement, the challenges this creates and how this is impacted by adopting a traditional process. For this blog were are going to take a much broader look at procurement and ask the question “are we actually using the right approach to give us the best chance of obtaining the value we are trying to generate?”

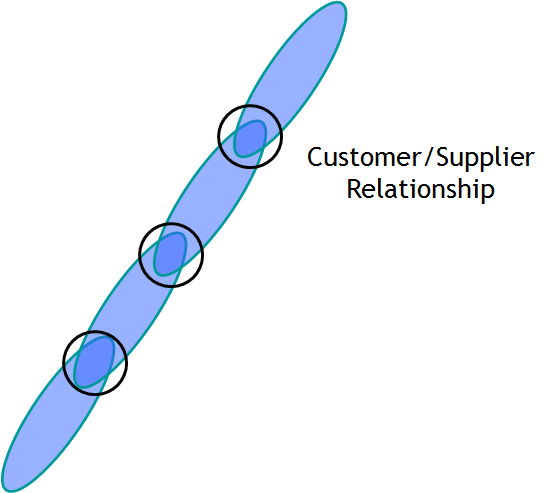

Let’s start with procurement at the highest level. When we buy stuff we are the customer and when we sell stuff we are the supplier. The people we are buying from are our suppliers and the people we are supplying to are our customers and they have suppliers and customers of their own. In its simplest form this creates a vertically integrated supply chain in which value is able to flow up and down the supply chain, so long as and this is the important bit, the relationships are mutually beneficial. So how do you ensure they are?

Supply Positioning Analysis

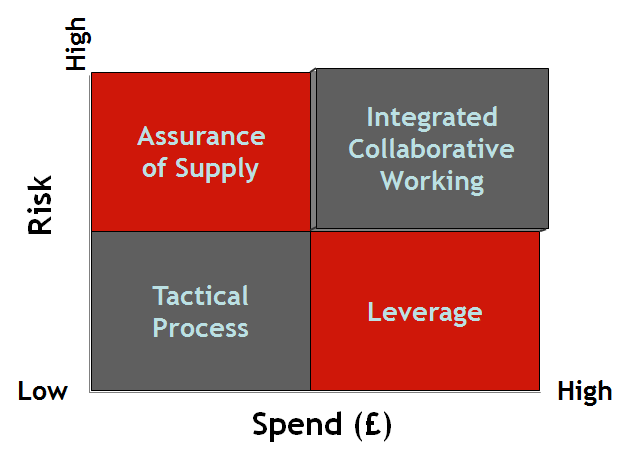

There are a number of different approaches a customer can adopt when buying things from its suppliers. Thinking strategically, there are two key factors that dictate which approach is best suited to which purchase. These are (i) the amount a customer spends on an activity or component and (ii) the risk to their operations associated with that spend.

This is known as Supply Positioning Analysis in which the product of these two factors creates different approaches to adopt as shown in the adjacent graphic. To use this as a tool a customer needs to evaluate the relative spend on a particular purchase and then consider the impact of what they are purchasing on their operational performance.

If the activity is relatively low risk, say it is highly regulated, freely available and you can manage without it or easily find an alternative supplier if necessary, say milk, motor fuels or building aggregates for example, then even if you spend a large amount relative to other purchases (bottom right hand box) you should use your leverage to procure as cheaply as you can each time you buy it. This is where supply and demand will primarily dictate the price you pay; if it’s readily available and you buy significant amounts you will probably be able to secure it at a lower price than the open market, but if it’s in short supply you will be paying a premium like everyone else who wants it. It is classic cheapest price territory and its fine if you are only buying low risk commodities. It is also the box that construction procurement most often heads towards even though much of what is being procured is not a commodity and some of the risks associated with the purchases are far from low.

So let’s look at the other strategies. Staying with low risk, what if you spend comparatively little on these purchases (bottom left corner)? Perhaps that’s envelopes in your organisation or screws and nails? Before talking more about this box, see if you can answer the following questions;

Q1. Do you know how much it costs to buy something in your organisation? This means the cost of raising a purchase order and/or invoice including the cost of processing including both direct time and indirect time (the time you lose doing something that can’t then be spent elsewhere), and

Q2. Does your organisation have a minimum order value?

Clearly if you operate your full process for everything purchased there will be occasions when it is costing you more to undertake the purchase than the cost of the purchase itself. The strategy for this box is to put in place some form of Tactical Process, such as establishing call off orders or issuing buying cards to those who need to make these kinds of purchases on a regular basis. Of course it’s not unusual for people to say they need to use the purchasing system to stop abuse, but then they are missing the point that these are low risk and low spend items and treating all those who are trustworthy with the same contempt as the few who aren’t does little for the moral or commitment of the majority.

Let’s move up to the top left box, where the relative spend is still low but the risk is now high. In these circumstances what matters most is the Assurance of Supply, meaning the purchase will arrive when it is needed and do what is required of it. It’s why people will pay a premium for business broadband so that those important mails are actually delivered when ‘send’ is hit and not stored on a server for delivery overnight. Conversely, it could be the reason the new hospital isn’t going to open on time because the emergency generator bought for the cheapest price still hasn’t left the factory a months after the critical path delivery date.

Finally we get to the top right corner box. This is where your relative spend is high and you are buying things that are highly important to your operational performance. Typically it is where determining the best solution is complex and generally achieved through interaction and frequently through the interaction of more than just one party involved in the delivery of related activities and components. This is where you seek to build ownership and commitment and if you are a repeat procurer, a long term relationship, which the Collaborative Working Champions of Constructing Excellence’s described as Integrated Collaborative Working.

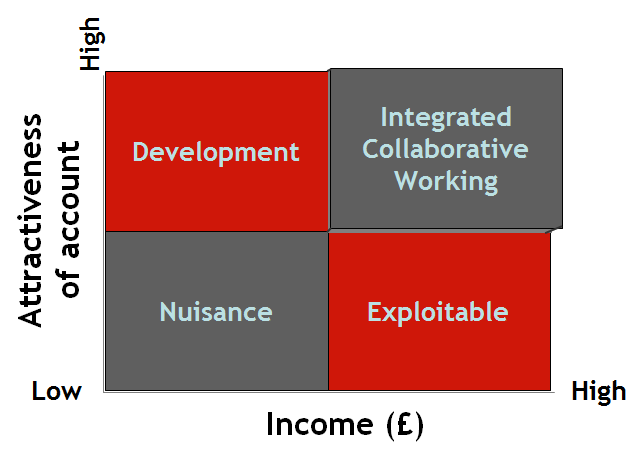

Customer Relationship Positioning

Of course it’s all well and good for customers to strategically evaluate how to procure their suppliers, however, many forget that they do not have exclusivity over these thoughts as their suppliers are looking back at them with their own strategic evaluation going on as the following graphic shows.

Known as Customer Relationship Positioning, it also comes with its own four box analysis based on the income that is generated from a customer and the attractiveness of that account. Whilst income is relatively straightforward, attractiveness takes a bit of thinking about. It will mean different things to different people so let’s take a look at it in detail.

As before let’s start with the bottom right hand box. This is where customers often misunderstand their influence and mistakenly believe they hold all the cards. These are customers who are responsible for a significant amount of supplier income, but crucially are not seen as an attractive account. Now that could be because we are back in the pure commodity territory and there is less to differentiate customers and so the rules of supply and demand remain king, but more often than not it is because the customers comprehensively fail to understand what makes them unattractive. It is not sufficient just to give out lots of work, if your procurement process is slow to respond and difficult to navigate, if your appointments appears confused or even unfair and your payments terms unreasonable, or you constantly change your mind about your requirements and refuse to accept your part in the costs your suppliers subsequently incur, then you are far from attractive no matter who you are. If you behave like this don’t be surprised that the people who will work with you see you and treat you as an Exploitable customer.

And if you behave like this and do not account for a significant amount of your supplier’s income (see case study below) do not be surprised if your suppliers suddenly consider you to be a Nuisance and walk away or fail to respond to your enquiries. Well actually do be surprised as in our experience there is very little strategic assessment undertaken by customers or suppliers and so there are plenty of organisations that work repeatedly with customers who drive them bonkers!

It’s very easy to misunderstand what significant means as a large supermarket chain with an expansion programme demonstrated during their boom years. They presumed that because they were doing a lot of building activity suppliers would see them as significant purchasers so they should use their buying power to procure building materials cheaper than their building contractors. What they missed was that although the amount of say doors they were buying was significant to them, compared to the amount procured by their contracting partners it was almost trivial to the manufacturers and any perceived savings made in procurement were quickly lost in delivery delays and quality issues.

Of course customers can take control of the situation by improving their attractiveness. Even those who only provide modest amounts of income can improve the service they receive from their suppliers by becoming more approachable, improving clarity of opportunities, adopting better payment processes (e.g. project bank accounts), engaging in discussion and negotiation and providing appropriate compensation when changes is necessary. Meaning they become seen as a Development opportunity even if in some cases this is just because the experience is so much better than the norm. And for one off customers, pooling activities with other similar customers can increase the available income stream to further enhance attractiveness, which is essentially one of the key principle of framework procurement.

This brings us to the final (top Right) box where the customer is both considered to be attractive and the amount of spend is significant. These are the customers that suppliers will want to engage with through Integrated Collaborative Working and ideally be appointed on a repeat or long term basis wherever possible.

Top Right Overlap

It is towards the occupiers of these two top right boxes that the CW Champions messages are primarily aimed and especially to those that see each other in the same box. This is the place where collaborative behaviours should be the norm and where mutual benefit and value can be achieved through integration; working together to improve products and strip out the wastes and inefficiencies that burden both sides of the Customer/Supplier interaction and thus enabling the flow of value up and down the supply chain.

However, it is also important to realise that there are two different types of integration going on. On one hand there is project integration where customers and suppliers are drawn together to deliver a particular project outcome for the duration of that project. Transcending the protect time line is supply chain integration where ongoing and frequently long term relationships are often the norm and huge opportunities exist to strip out transactional inefficiencies rarely addressed in the project environment, such as open book paper free invoicing, shared people and product development and inventory reduction to name but a few.

It is important to appreciate that these tools are primarily for the immediate relationships and the further one gets from a particular supplier in the chain the more a customers’ influence wanes wherever they appear in the grid. In construction it is usual for the customer, or their advisors, to try to influence supplier’s two, three or even four links down the chain, diluting whatever influence they have except on the most exceptional circumstances; we will look at the impact alliancing has on this in a later blog.

What the customer can do is look at their first level suppliers and examine their supply base. If that supplier has an Integrated Collaborative Relationship with their suppliers then that should be a strong influence in the choice of both the immediate supplier and their suppliers. They will be able to contribute much more to a project from the outset and help to successfully manage the unavoidable fragmentation as multiple products or skills are introduced to a project.

Summarily for suppliers it is extremely difficult to indirectly influence the customers of a customer of yours. However, you can almost certainly add value to your customer propositions if you have a good grasp of their customers’ needs since these will directly influence what it is they are looking for you to assist them with.

Taken together, strategic partnerships based on integrated collaborative working principles provide the opportunity to radically transform our industry and at the same time strip out the embedded waste and inefficiency that we have so far failed to eliminate, the final point being the subject of a later blog in this series. However, do remember that it is important to understand both perspectives as just because someone appears in one of your boxes it does not immediately follow that you appear in the corresponding version of their boxes.

Behavioural Changes to Adopt

- Understand what kind of customer you actually are; check with your supply chain but confidentially, ideally through a third party, if you really what to know the truth

- Evaluate the risk profile of your purchases (as an aside also review your disaster recovery arrangements for high risk activities/components)

- Only apply a leverage approach to items that are genuinely low risk

- Make sure your buyers understand your business risks

- Be clear about how significant your buying is in the market place

- Evaluate how much it costs you to buy stuff and put a minimum order value in place

- Work out how to buy low risk stuff more simply

- Don’t use procurement to control behaviour

- Be prepared to pay a premium when it matters; if your organisation can’t currently justify it, change your evaluation process to include the appropriate critical factors

- Stop working with nuisance customers and if they are all you have, take a good hard look at your business strategy

- When you look at your suppliers also look at their suppliers and the relationships they have. Try to use established Integrated Collaborative Relationships where they already exist and where possible encourage such relationships.

- Work out how to make yourselves more attractive – it will pay back in the long run

- If you are an ‘occasional’ – pool your activity with others so you can offer and benefit from continuity of opportunities

- If you want to understand the benefits of sustained integration get a manufacturer to explain their supply chain to you

- A long term relationship doesn’t mean you have to do everything with one supplier you can have a small pool of suppliers and still provide long term intermittent repeat business

With thanks to Ron Edmondson (Waterloo) and Keith Hayes (Graham) for their input and improvements.

Kevin Thomas

Chair and Coach of the Collaborative Working Champions of Constructing Excellence and Founding Director of Integrated Project Initiatives Ltd, the creators and delivery organisation for the Integrated Project Insurance (IPI) Delivery Model.

This blog is part of the Collaborative Working Champions series of ten blogs on Modern Collaborative Working

Comments are closed.